An estimated 150,000 km of legacy seismic lines across Alberta will require some type of intervention to be placed on a trajectory to full recovery.

The challenge is that linear restoration is expensive. Restoration costs can vary depending on required treatments and the landscape characteristics of the ranges (e.g. remote locations, wet areas, etc.). A sustainable funding model is imperative for the success of such a large initiative.

There are several funding alternatives being discussed as possible solutions:

- Government funds

- Green bonds

- Environmental markets

- In lieu payments/levies

Each funding alternative has its own advantages and disadvantages. For example:

- Government funds reduce the burden on private industry, but funds may not be prioritized for linear restoration into the future

- In lieu payments are well understood and low risk for both government and private industry, but put a ceiling on how much a proponent is willing to pay to implement restoration efforts

- Environmental markets can create new investment opportunities in the province but have remained generally untested in Canada

The Denhoff Report recommended, “an innovative Government-backed, energy industry-paid Green Bond program to reduce cash flow impacts to affected companies.” Green bonds use debt capital to fund projects that have a positive environmental benefit. The demand for green bonds is on the rise, with the market totaling approximately $82 billion in 2017 according to a report issued by RBC Capital Markets.

If this approach was taken, the bond could be issued by the GoA to cover the full cost of restoration. Private investors would then have the opportunity to purchase the bond at regular rates. Over the term of the bond, industry would make payments to the government, ear-marked for the repayment of the bond plus interest at maturity. This would limit the impact of reduced cash flows for companies operating in caribou ranges, while also providing an investment opportunity for the private sector.

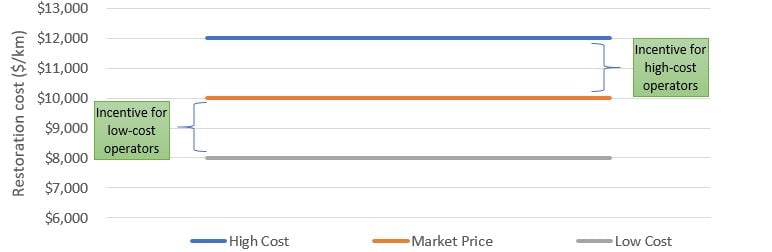

Conservation offsets, on the other hand, will encourage large-scale uptake of restoration efforts by creating winners – companies who can complete restoration work faster and cheaper than competitors, while still meeting the quality standards and objectives of the restoration project. For example, if Company X was to establish themselves as a low-cost operator for linear restoration, and could complete the work at $2,000/km less than the market price, they would be able to sell restoration credits at the market price, gaining $2,000/km in revenue. Then, Company Y who cannot beat the market price will have the option to buy credits, saving them the difference between their restoration cost and the market price.

Green bonds paired with a conservation offset policy will likely jump-start industry-led restoration in the province. As more restoration is completed over time, a mitigation banking system could also be implemented or encouraged to ensure the province remains in “net positive” restoration management into the future.

Net positive restoration management means managing development to ensure the area of initial restoration of historical and existing footprint exceeds the area of new footprint

As part of the Alberta Innovates-funded project “Assessing the Ecosystem Service Benefits of Linear Restoration”, Silvacom further explored the benefits and risks of implementing alternative funding models to pay for linear restoration. If you would like a copy of the report or additional information, contact us.